Rachel Reeves was offered some relief today as official figures showed the UK economy clawing back ground in November.

GDP grew by 0.3 per cent across the month, a better performance than most analysts had pencilled in.

It followed a 0.1 per cent dip in October, and could take some pressure off the Chancellor.

However, the uptick came largely before the Budget on November 26, when Ms Reeves hit the economy with another barrage of taxes.

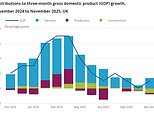

The UK barely scraped into positive territory over the latest three months, recording 0.1 per cent expansion after flatlining in the period to October.

Rachel Reeves was offered some relief today as official figures showed the UK economy clawing back ground in November

The economy scraped into positive territory in the three months to November, having flatlined in the three months to October

Previous estimates of a 0.1 per cent decline in September have been revised to 0.1 per cent growth, with the Office for National Statistics saying stronger data had been received from the pharmaceutical sector.

November was assisted by a 25.5 per cent jump in the motor manufacturing industry after JLR’s factory shutdown saw a huge slump in September.

Tax consultants also had a bumper month, with activity surging amid the frenzy over the Budget, and following a 2.4 per cent decline in October.

Overall growth in November came despite many firms reporting caution in the run-up to the autumn Budget near the end of the month.

ONS Director of Economic Statistics, Liz McKeown said: ‘The economy grew slightly in the latest three months, led by growth in the services sector, which performed better in November following a weak October.

‘This was partially offset by a fall in manufacturing, where three-monthly growth was still affected by the cyber incident that impacted car production earlier in the Autumn.

‘However, data for the latest month show that this industry has now largely recovered.

‘Construction contracted again, registering its largest three-monthly fall in nearly three years.’

An HM Treasury spokeswoman said: ‘To make the economy work for working people, we are reversing years of underinvestment by protecting record infrastructure investment, driving through major planning reform, backing expansion at Heathrow and Gatwick, delivering Northern Powerhouse Rail and getting Sizewell C built.

‘At the same time, we are taking action to get bills and inflation down – with £150 off energy bills, rail fares, prescription charges and fuel duty all frozen, the two-child benefit cap lifted, alongside the national living wage to deliver an economy that works for working people.

‘There’s more to do – driving growth, delivering the consolidation to provide stability, keeping inflation low and stable, tackling the cost of living and bringing our borrowing costs down.’

But shadow chancellor Mel Stride said: ‘This morning’s news that growth is flatlining is more evidence of Labour’s economic mismanagement.

‘Growth was just 0.1 per cent in the three months to November, having not grown at all in the previous three month period.

‘Because Labour made the wrong choices, their Budget is unravelling day by day. Despite Labour’s U-turns on the Family Farms Tax and Business Rates, their Budget will still leave working people worse off and our economy weaker, with higher taxes stifling growth and fueling inflation.

‘With every U-turn, the Chancellor loses more credibility, and Labour show they do not have a plan. Only the Conservatives have a leader with a backbone, a strong team, and a clear plan to build a stronger economy and get Britain working again.’

Suren Thiru, ICAEW Economics Director, said the prospects of a February interest rate cut were probably lower due to the brighter growth picture.

‘These figures confirm an unexpectedly upbeat November for the economy, as most sectors seemingly shrugged off pre-Budget uncertainty, though were flattered somewhat by the uplift to manufacturing from Jaguar Land Rover’s return to production,’ he said.

‘November’s uptick means it’s inevitable that the UK economy grew modestly across the final quarter of 2025 with easing uncertainty post-Budget likely to have supported growth in December, despite the ‘super flu’ disrupting activity in sectors like education.

‘This return to growth probably won’t trigger a sustained economic revival with softer consumer spending amid an intensifying tax burden and higher unemployment likely to mean noticeably weaker growth for 2026, despite a boost from lower inflation.’